By 2050, almost half of Australian households and businesses will have installed rooftop PV systems, many with accompanying storage devices and electric vehicle chargers, according to a new joint report by AEMO and energy transmission and distribution body Energy Networks Australia. Integrating this flexible and widely distributed resource into an accessible and transparent two-way energy system could save some $100 billion on new network infrastructure by 2050, with around $1 billion delivered to consumers from around 2030.

The Required Capabilities and Recommended Actions Report released today represents interim recommendations for development of a future energy grid that manages Australia’s rooftop solar boom to support reliable and safe electricity flows for all energy consumers, and further informs development of AEMO’s overall Integrated System Plan.

“The recommendations in this report are designed to shape a future electricity grid that enables us to keep prices down, keep the lights on and to maximise our use of localised solar storage,” said Energy Networks Australia CEO Andrew Dillon in a statement.

Part of a major joint project, known as Open Energy Networks (opEN), being developed by the two energy organisations, the report is supported by other studies and reports conducted to date, such as a Cost Benefit Framework produced by CSIRO.

Merely the ‘moderately’ sunny forecast

Under a scenario of ‘moderate’ solar PV uptake, CSIRO projects that by 2050, Australia will have distributed energy resources (DER) that include 26 GW of residential rooftop PV; 13 GW of commercial rooftop solar and 20 GW of combined residential and commercial battery storage.

The objectives of the new Required Capabilities report are firstly to ensure that technically the Wholesale Electricity Market (WEM) in the west, and the eastern and southern states’ National Electricity Market (NEM) will cope with such high distributed generation, allowing customers to continue to connect and “receive the full benefits from their solar and storage devices”, including some payment for energy shared to the grid.

It also aims to improve power quality and reliability at the lowest cost to customers; and to harness and manage the collective DER in such a way that power supply is ensured, and investment in new generation and infrastructure are optimised for a system able to manage peak demand — rather than building expensive infrastructure to meet the highest possible expected electricity demand, as occurred in the less demand-responsive past.

“Our electricity grid was not built to accommodate large amounts of power being generated back into it from multiple small sources,” says Dillon, and this limitation is at the heart of a web of challenges that the report seeks to address.

An initial consultation paper identified three potential market frameworks, and a fourth, hybrid, model has been included in the report, in response to feedback on the first batch of frameworks.

Milestones on the road to an open energy future

Perhaps most important in Required Capabilities are the milestones required to achieve an optimised energy system that integrates rather than curtails or limits DER participation: the first milestone and capabilities relate to defining the network visibility requirements that will provide distributed network service providers (DNSPs) the oversight and real-time information to maintain and manage integrated network operations.

The second milestone relates to definition of network constraints or operating envelopes so customers can be informed of how much electricity they can export or import from the grid at any given time; and the third to establishing industry standards for communicating operating envelopes to all participants, such that the safe and secure operation of the network are ensured.

“It’s not like none of these three are being done now,” Dillon told pv magazine. He says work is already underway on system visibility, and on analysis that will “determine what local areas can handle, particularly in terms of export”. And studies underway are identifying systems and protocols to best govern a modernised, integrated system.

“We’re not starting from nothing, but it is about making sure we’re co-ordinated as we go through this process,” says Dillon.

Among other recommended actions: strategic management of DER integration into the wholesale electricity market; collaboration among industry participants to improve network demand and forecasting; establishment of pricing signals for DER customers, and trialling of new market mechanisms.

In a statement accompanying the release of the report, Audrey Zibelman, Managing Director and CEO of AEMO emphasised that this interim document highlights a “once-in-a-lifetime opportunity” for Australia to move to a two-way system of electricity production and distribution.

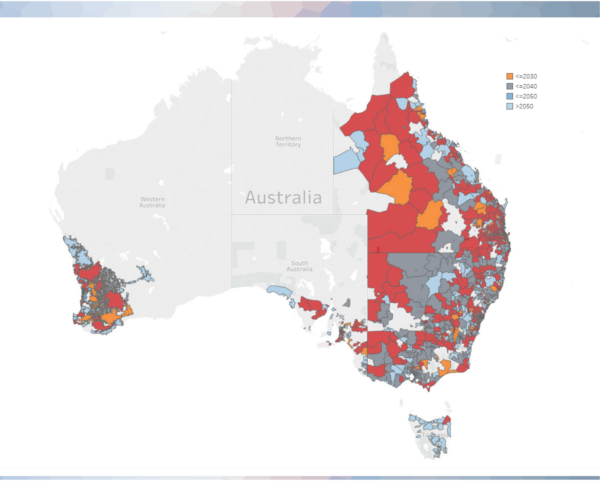

Modelling carried out as part of OpEN has been mapped to show where areas of constraint on the network are forming; and when they will reach thresholds of solar adoption and critical states of ‘reverse flow’. Some areas in South Australia and south-east Queensland have already met the threshold, and solar or solar-and-battery rebate and interest-free loan schemes in almost all states of Australia continue to drive uptake that increases both the potential resource and the looming challenges. Red zones on the map below indicate where optimisation of the network is urgent.

postcode in the NEM and WEM will reach a threshold penetration (40%) of rooftop

solar adoption. The projection is indicative of reverse demand/power under the NEM Electricity Statement of Opportunities ‘neutral’ DER uptake scenario.

Map: AEMO and Energy Networks Australia

Dillon says that the risks of not acting now to enable a co-ordinated system include one or a combination of three scenarios: “as we’ve already started to see in some patches across the country, networks will be telling new solar connections that they can connect, but they can’t export”; networks will “spend a fortune to enable more capacity, which everyone will then pay for”; and/or too many people will connect for the system to be able to operate reliably. “We’re already seeing some voltage issues,” says Dillon, and localised outages will follow.

Next steps

Following further consultations and engagements — including with the Australian Energy Market Commission to identify regulatory changes that may be required to progress the blueprint for action — publication of the final OpEN report is expected in Q4 of this year.

In addition to detailed cost benefit analysis of each of the four frameworks presented today, it will recommend a preferred framework.

Zibelman envisages “a future where consumers’ controllable devices will have a marketplace to supply not just energy, but system and network services that reduce overall energy costs and help maintain system security.”

Being able to call on an anticipated 200,000 household batteries for short periods of high demand or system instability represents an undeniable benefit to Australia’s energy system. If well co-ordinated, says Dillon, having flexible storage, “pretty much on demand” at the local level could help facilitate more investment in and connection of renewable generation, both at the utility scale, and at rooftop level.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.