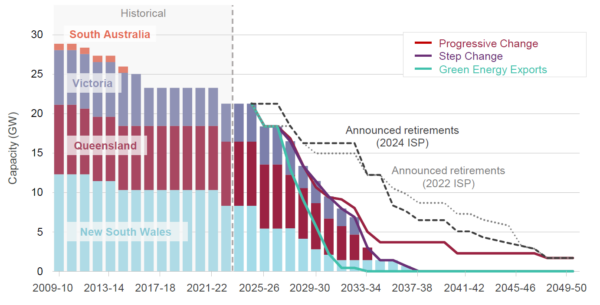

The Australian Energy Market Operator’s 2024 Integrated System (ISP) plan roadmaps how the National Electricity Market (NEM) will be 100% weaned off coal generation by 2038, teaming renewables connected by transmission and distribution, firmed by storage, and backed by gas as the way forward.

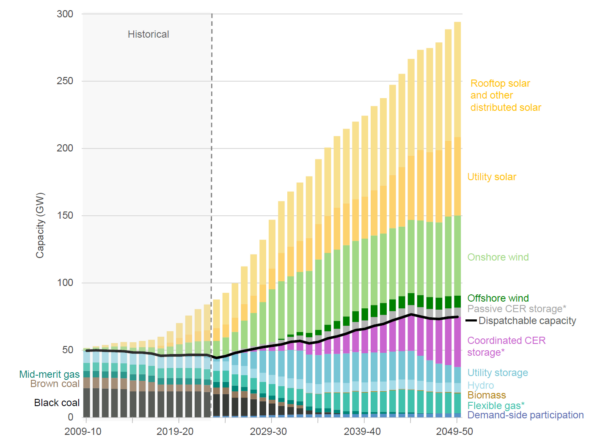

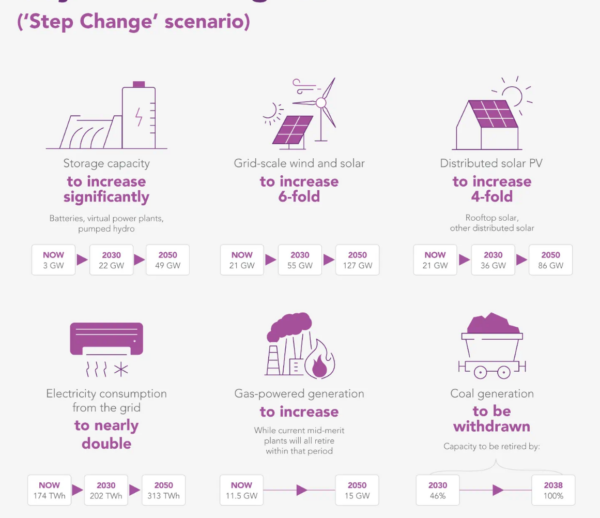

This optimal development path (ODP) uses AEMO’s Step Change scenario to forecast future demand and calls for investment that will triple grid-scale variable renewable energy (VRE) by 2030 and increase it six-fold, from today’s 21 GW to 127 GW by 2050.

Storage capacity needs to increase from today’s 3 GW to 49 GW by 2050, distributed solar from 21 GW to 86 GW, coal generation will be 46% retired by 2030 and 100% by 2050, and gas-powered generation would need to increase from 11.5 GW to 15 GW, though current mid-merit plants will all retire in that period.

Image: Australian Energy Market Operator

AEMO Chief Executive Officer Daniel Westerman said the plan maps out urgent investment so that homes and businesses continue to access reliable and affordable electricity, both in the coming decade when 90% of coal generation is expected to retire, and beyond to 2050.

“As with previous reports, this plan shows that the lowest-cost path for secure and reliable electricity is from renewable energy, connected with transmission and distribution, supported by batteries and pumped hydro, and backed up by gas-powered generation,” he said.

The ISP states about 6 GW of capacity needs to be added annually, up from the current yearly rate of 3 to 4 GW, achieved mainly through wind installations to 2030, complementing rooftop solar systems, and by 2050 grid-scale solar capacity would be 58 GW and wind 69 GW.

It calls for a focus on grid-scale generation in renewable energy zones (REZ)s, to support grid reliability and security; reduce transmission, connection and operation and promote regional expertise and employment at scale.

Firming capacity will need to quadruple from sources alternative to coal that can respond to a dispatch signal, using grid-scale batteries, pumped hydro and other hydro, coordinated consumer energy resources (CER) as virtual power plants (VPP)s and gas-powered generation.

This would include 49 GW/ 646 GWh of dispatchable storage, as well as 15 GW of flexible gas.

Image: Australian Energy Market Operator

The ODP supports a four-fold increase in rooftop solar capacity reaching 72 GW by 2050 and says these and other CER such as residential batteries, smart systems and electric vehicles are integral to reaching transition targets.

“Consumers are already a driving force in Australia’s energy transition, and this is set to continue. If consumer devices like solar panels, batteries and electric vehicles are enabled to actively participate in the energy system, then this will result in lower costs for all consumers,” Mr Westerman said.

Popular content

The annualised capital cost in the ODP of all utility-scale generation, storage, firming, and transmission infrastructure has a present value of $122 billion.

The transmission projects cost $16 billion but are expected to recoup their investment costs and, additionally, save consumers $18.5 billion in avoided energy costs and deliver emissions reductions valued at a further $3.3 billion.

The ODP identifies almost 10,000 km of new transmission required to connect new sources of generation and meet reliability targets at the lowest cost to consumers, with ten projects (2,500 km) underway, including HumeLink and Project Marinus.

A further seven projects progressing through planning and delivery include the Hunter-Central Coast REZ Network Infrastructure project, the Queensland SuperGrid South and Mid North South Australia REZ Expansion project.

Twelve future ISP transmission projects include renewable energy zone expansions at the Central West Orana REZ, the Darling Downs REZ, the North West Tasmania REZ, and North Queensland Energy Hub.

Market challenges are identified as approval process delays, investment uncertainties, cost pressures, social licence issues, supply chain disruptions, and workforce shortages.

“This ISP is a clear call to investors, industry and governments for the urgent delivery of generation, storage and transmission to ensure Australian consumers continue to have access to reliable electricity at the lowest cost.” Westerman said.

Image: Australian Energy Market Operator

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.